The question of whether big law attorneys should utilize the standard deduction or itemize their deductions is a complex one, heavily influenced by their unique high-income circumstances and significant potential for deductible expenses. This guide delves into the intricacies of tax optimization for high-earning legal professionals, providing a clear comparison of both strategies and offering insights into maximizing tax benefits.

Navigating the tax code is crucial for financial success, especially for big law attorneys who often face high incomes and complex financial situations. Understanding the nuances of deductions, from business expenses and charitable contributions to home office write-offs, is essential for minimizing tax liability. This detailed analysis will equip you with the knowledge to make informed decisions about your tax strategy.

Tax Implications for High-Income Earners

High-income earners, particularly big law attorneys, face unique tax challenges due to their substantial salaries and often complex financial situations. Understanding the nuances of the standard deduction versus itemizing deductions is crucial for minimizing their tax liability. This section will explore the tax implications of these choices and provide practical examples relevant to high-earning attorneys.

Itemizing Versus Standard Deduction for High-Income Attorneys

The decision to itemize or take the standard deduction hinges on whether the total value of itemized deductions exceeds the standard deduction amount. For high-income attorneys, this often involves a careful analysis of several deductible expenses. The standard deduction provides a fixed amount, while itemizing allows for deducting specific expenses, potentially leading to a lower taxable income if the total exceeds the standard deduction. However, the complexity of itemizing, including meticulous record-keeping, must be weighed against the potential tax savings.

Common Itemized Deductions for Big Law Attorneys

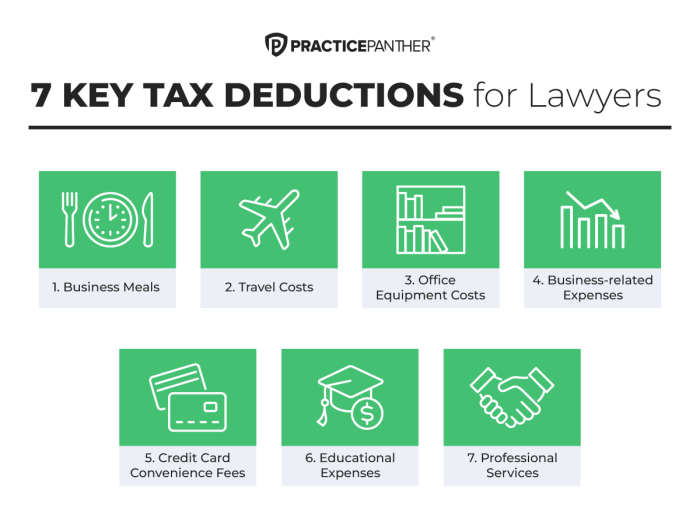

Big law attorneys frequently have several potential itemized deductions. These include home office deductions (if a portion of their home is used exclusively and regularly for business), business expenses (travel, professional development, client entertainment, within IRS guidelines), and charitable contributions (to qualified organizations, subject to limitations). Each deduction requires proper documentation and adherence to IRS regulations to ensure its validity.

Scenarios Favoring Itemization

Itemizing becomes more advantageous when the sum of an attorney’s itemized deductions surpasses their standard deduction. For instance, an attorney working extensively from home with significant unreimbursed business expenses and substantial charitable contributions might find itemizing significantly reduces their taxable income. Consider an attorney who spends $10,000 on unreimbursed business expenses, $5,000 on charitable contributions, and qualifies for a $5,000 home office deduction. If their standard deduction is $25,900 (2023 single filer), itemizing would result in a $20,000 ($5,000+$5,000+$10,000) reduction in taxable income compared to the standard deduction.

Comparison of Standard Deduction and Itemization Across Income Levels

The following table illustrates a simplified comparison, recognizing that actual itemized deduction potential varies greatly based on individual circumstances and available deductions. Note that these are illustrative examples and do not encompass all possible deductions or tax situations. Consult a tax professional for personalized advice.

| Income Bracket | Standard Deduction (Single Filer, 2023) | Itemized Deduction Potential (Illustrative Example) | Net Taxable Income Difference |

|---|---|---|---|

| $200,000 – $250,000 | $13,850 | $25,000 | $11,150 (Itemizing saves $11,150) |

| $250,000 – $300,000 | $13,850 | $35,000 | $21,150 (Itemizing saves $21,150) |

| $300,000 – $400,000 | $13,850 | $45,000 | $31,150 (Itemizing saves $31,150) |

| >$400,000 | $13,850 | $60,000 | $46,150 (Itemizing saves $46,150) |

Charitable Contributions and Deductions

High-income earners, particularly big law attorneys, often have significant opportunities to reduce their tax liability through charitable giving. Understanding the rules and limitations surrounding charitable contribution deductions is crucial for maximizing these benefits. This section details the specifics of claiming these deductions.

Charitable Contribution Deduction Rules and Limitations for Big Law Attorneys

The deduction for charitable contributions is subject to several rules and limitations. For cash contributions, the deduction is generally limited to 60% of the taxpayer’s adjusted gross income (AGI). However, for contributions of certain types of property, such as capital gain property (e.g., appreciated stock), the limitation can be different, often capped at 50% of AGI. It’s also important to note that for contributions to private foundations, the limit is generally 30% of AGI. Big law attorneys, often with high AGIs, need to carefully track their contributions to ensure they don’t exceed these limits. Exceeding the limits doesn’t negate the entire deduction; it merely means the excess portion cannot be claimed in that tax year, potentially affecting future tax planning. Accurate record-keeping is paramount.

Cash Versus Non-Cash Contributions

Cash contributions are straightforward to deduct. A canceled check or bank statement showing the donation is usually sufficient documentation. Non-cash contributions, such as property or stock, require more detailed documentation. For appreciated property, the taxpayer can deduct the fair market value (FMV) at the time of the donation, but the deduction may be limited to the lesser of the FMV or the donor’s basis. If the property is donated to a public charity and held for more than one year, the capital gains tax is generally avoided, offering significant tax advantages. However, if the property is held for less than one year, the ordinary income tax rate may apply to the portion exceeding the donor’s basis. Donating stock with appreciated value often proves more tax-efficient than selling the stock and then donating the proceeds. The tax savings can be substantial, making it a preferable strategy for many high-net-worth individuals.

Types of Charitable Contributions and Deduction Limits

The following table summarizes different types of charitable contributions, their deduction limits, required documentation, and relevant tax forms. Note that these are general guidelines, and specific situations may require additional considerations.

| Type of Contribution | Deduction Limit | Supporting Documentation Needed | Tax Form |

|---|---|---|---|

| Cash | Generally 60% of AGI | Canceled check, bank statement | Schedule A (Form 1040) |

| Appreciated Stock (held > 1 year) | Generally 50% of AGI | Brokerage statement showing purchase and donation dates, appraisal if necessary | Schedule A (Form 1040), Form 8283 (if donation exceeds $500) |

| Appreciated Stock (held < 1 year) | Generally 50% of AGI; ordinary income may apply to excess | Brokerage statement showing purchase and donation dates, appraisal if necessary | Schedule A (Form 1040), Form 8283 (if donation exceeds $500) |

| Other Property (e.g., clothing, household goods) | Generally 50% of AGI; fair market value limited | Appraisal if value exceeds $500 | Schedule A (Form 1040), Form 8283 (if donation exceeds $500) |

| Contribution to Private Foundation | Generally 30% of AGI | Acknowledgement letter from the foundation | Schedule A (Form 1040) |

Impact of Charitable Contributions on Tax Liability

Consider a big law attorney with an AGI of $500,000 who donates $100,000 in cash to a qualified charity. They can deduct up to $300,000 (60% of their AGI). This reduces their taxable income, resulting in a lower tax liability. If they donated $350,000, only $300,000 would be deductible in that tax year. The remaining $50,000 could potentially be carried forward to future tax years. Conversely, if the attorney donated appreciated stock worth $100,000 held for over a year, with a basis of $10,000, they could deduct the full $100,000 (subject to the 50% of AGI limit), potentially avoiding the capital gains tax on the $90,000 appreciation. The specific tax savings would depend on their marginal tax bracket. Careful planning is crucial to maximize the tax benefits.

Tax Planning Strategies

Proactive tax planning is crucial for high-earning big law attorneys to minimize their tax liability and maximize their after-tax income. Effective strategies involve a combination of understanding deductions, managing income streams, and strategically choosing a filing status. This section Artikels key approaches to achieve significant tax savings.

Income and Expense Management

Careful management of income and expenses is paramount for optimizing deductions. Attorneys should maintain meticulous records of all business-related expenses, including continuing legal education (CLE) courses, professional memberships (e.g., state bar associations), subscriptions to legal databases (e.g., Westlaw, LexisNexis), home office expenses (if applicable and meeting IRS requirements), and business travel. These expenses can be deducted from gross income, thereby reducing taxable income. Furthermore, attorneys should explore opportunities to defer income where possible, such as through qualified retirement plans (e.g., 401(k)s, SEP IRAs), to reduce their current year’s tax burden. Conversely, accelerating deductions, such as prepaying certain business expenses, can also be beneficial. For example, prepaying next year’s professional dues can reduce this year’s taxable income.

Filing Status Implications

The choice of filing status significantly impacts the standard deduction amount and the overall tax liability. Single filers have a lower standard deduction than those married filing jointly. Married couples filing jointly generally benefit from a higher standard deduction and potentially lower tax rates compared to filing separately. The decision of whether to itemize or take the standard deduction depends on the individual’s specific circumstances. If itemized deductions exceed the standard deduction, itemizing is advantageous. For example, a single attorney with significant mortgage interest, state and local taxes (SALT), and charitable contributions might find itemizing more beneficial than claiming the standard deduction. A married couple with fewer itemized deductions may find the standard deduction more advantageous. It’s important to compare both scenarios to determine the most tax-efficient option.

Hypothetical Tax Savings Examples

Consider two hypothetical scenarios:

Scenario 1: A single attorney, Sarah, earns $300,000 annually. Her itemized deductions total $35,000, exceeding the standard deduction of $13,850 (2023). Itemizing reduces her taxable income by $35,000, resulting in substantial tax savings compared to taking the standard deduction. The exact amount saved depends on her applicable tax bracket.

Scenario 2: John and Mary, a married couple, earn a combined $450,000 annually. Their itemized deductions total $20,000. In this case, the standard deduction of $27,700 (2023) is higher, making it more advantageous to claim the standard deduction than to itemize. They will pay less in taxes by taking the standard deduction.

These examples illustrate the importance of evaluating both itemized deductions and the standard deduction to determine the optimal tax strategy. It’s crucial to remember that tax laws are complex and subject to change, making professional tax advice essential. The specific tax savings will vary depending on individual circumstances and the current tax laws.

End of Discussion

Ultimately, the decision of whether to itemize or take the standard deduction hinges on a careful analysis of an individual attorney’s specific financial circumstances. While the standard deduction offers simplicity, itemizing can yield substantial tax savings for those with significant deductible expenses. Proactive tax planning, coupled with expert advice, is paramount to ensuring compliance and maximizing financial well-being. Remember, consulting a qualified tax professional is strongly recommended to navigate this complex landscape effectively.

Common Queries

What are some common pitfalls attorneys make when claiming business expenses?

Common pitfalls include inadequate record-keeping, claiming personal expenses as business expenses, and not understanding the limitations on certain deductions. Proper documentation and seeking professional advice are crucial to avoid these mistakes.

Can I deduct the cost of continuing legal education (CLE) courses?

Generally, yes. CLE courses are considered a deductible business expense, helping maintain professional competency.

What is the difference between cash and non-cash charitable contributions?

Cash contributions are straightforward deductions up to a certain percentage of your income. Non-cash contributions (like property or stock) have more complex rules, including limitations on the deduction amount and requirements for substantiation.

How does my filing status affect my deduction choices?

Your filing status (single, married filing jointly, etc.) impacts both the standard deduction amount and the potential benefits of itemizing. Higher filing statuses often have higher standard deductions.